The landscape of RSO production is witnessing a period of significant expansion. This can be attributed to several key trends, like: the growing need for RSO products, accompanied by advancements in extraction methods. Consequently, we are noting a boom in the volume of RSO producers, in addition to a evolving range of products available for sale. This landscape is projected to continue to influence the future of RSO production.

Discovering Riches: RSO's Untapped Market Value

The rapidly transforming market landscape presents numerous opportunities for savvy investors. Among these, RSO ({rawsupply chains) is emerging as a particularly promising sector with immense potential. This trend is driven by growing global demand for specializedmaterials and the unique advantages that RSO offers.

- From consumer applications, RSO provides essentialbuilding blocks that are critical to modern production.

- Moreover, the sustainability of RSO is gaining traction as consumers seek responsibleapproaches.

- Therefore, investing in RSO presents a attractive opportunity to leverage in this thrivingsector.

Delving into the Global RSO Oil Scene

The global RSO oil landscape is a dynamic and shifting environment. Companies must meticulously thrive in this competitive market to achieve success. Factors such as global demand, legal frameworks, and technological advancements all play a significant role in shaping the RSO oil industry.

- Comprehending the nuances of different regions is essential for future RSO oil players.

- Thorough research of existing projects and trends can provide valuable information.

Building strong connections with industry entities is crucial for partnership. Transparency in operations and adherence to ethical practices are fundamental for long-term viability within the global RSO oil landscape.

RSO Standardization and Market Certification

Achieving consumer acceptance for RSOs requires adherence to rigorous quality norms. These standards, often established by governing bodies, define the necessary requirements for RSO functionality, security, and efficiency. Market accreditation programs provide a formal assessment process to ensure that RSOs meet these established standards. This certification can strengthen market confidence and enable wider utilization of compliant RSOs.

- Organizations seeking market approval often undergo a thorough validation process to demonstrate their RSO's conformance with established standards.

- Comprehensive evaluations are typically conducted to evaluate the RSO's performance and robustness.

- Accreditation schemes can change depending on the specific sector and the intended use of the RSO.

Prospects for the RSO Market

The future of the RSO market is bright, fueled by a wave of advances that are redefining the industry. Cutting-edge technologies are gaining traction, accelerating market growth and creating unprecedented opportunities for businesses and consumers alike.

One key area of innovation is in the field of process optimization. RSOs are implementing AI-powered solutions to enhance operations, improving productivity and lowering costs.

This trend is more info significantly impactful in industries such as logistics, where operational excellence is paramount.

Another significant advancement is the integration of RSOs with other technologies, such as big data analytics. This fusion is generating innovative business models and unlocking untapped potential.

For example, the integration of RSOs with cloud computing enables businesses to collect vast amounts of data in real-time, obtaining valuable insights that can be used to make better decisions.

The future of RSO is undeniably full of potential. As technologies continue to evolve, we can expect to see more profound transformations across industries, shaping the way businesses operate and consumers connect with the world.

Delving into RSO Investments

The realm of alternative/emerging/niche investments has seen a surge in interest/attention/scrutiny lately, with RSO/Real-World Securities Offerings/Digital Asset Representations emerging as a fascinating/promising/controversial new sector/industry/asset class. Understanding the complexities/dynamics/nuances of this market is crucial/essential/indispensable for investors/traders/participants seeking to navigate/leverage/exploit its potential/opportunities/risks.

A key driver/catalyst/factor behind the growth/expansion/popularity of RSOs is their ability/capacity/potential to democratize/disrupt/transform access to traditional/conventional/established investment vehicles/instruments/markets. By tokenizing/fractionalizing/representing real-world assets/properties/entitlements as digital tokens, RSOs offer enhanced/improved/greater liquidity/transparency/accessibility compared to their analog/traditional/offline counterparts. This opens up/creates/unlocks a wealth/range/spectrum of opportunities/possibilities/avenues for both individual/retail/amateur and institutional/corporate/sophisticated investors.

- However/Nevertheless/Despite this, the RSO market is still in its early/nascent/infancy stages, which presents/poses/involves a number of challenges/risks/uncertainties. Regulatory clarity/framework/guidance remains a crucial/pressing/significant issue, as governments around the world strive/endeavor/attempt to balance/harmonize/regulate innovation with consumer protection.

- Furthermore/Moreover/Additionally, the volatility/fluctuating nature/inherent risks of cryptocurrencies and digital assets can impact/influence/affect the value of RSOs, making them a risky/volatile/speculative investment proposition/vehicle/instrument.

Therefore/Consequently/Hence, it is essential/crucial/imperative for potential/aspiring/interested investors to conduct thorough/comprehensive/diligent research and understand the risks/challenges/complexities involved before participating/engaging/investing in the RSO market.

Jake Lloyd Then & Now!

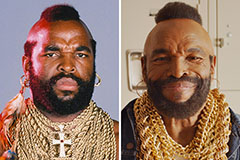

Jake Lloyd Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!